In leading the design research for OLX's expansion into OLX Autos, I conducted comprehensive design research to improve OLX's user experience, reduce drop-offs and increase conversion rates focusing on the pre-owned car market. This involved creating research briefs, setting clear objectives, establishing plans and timelines, conducting interviews, gathering and analyzing data, and deriving actionable insights. The findings guided our business and design teams in making informed decisions to shape the product's future and enhance user satisfaction.

Classified advertising, traditionally seen in newspapers and other periodicals, has transitioned effectively to digital platforms, connecting buyers and sellers through online listings. OLX leverages this format to become a leading online marketplace specializing in classified ads, enabling users to buy and sell goods across diverse categories on a large scale. At its peak, OLX dominated India’s used goods market, commanding a 90% share and offering listings in virtually every consumer category.

OLX strives to remain a destination for successful exchanges in pre-owned goods.

OLX, initially dominant in India's used goods marketplace across all categories, saw a significant rise in used car listings due to soaring new car prices. The COVID-19 pandemic further fueled this with reduced cash inflow, resulting in buyers seeking alternatives to new cars. As a result, OLX witnessed a pronounced shift towards the used car segment with increased numbers of people preferring individual mobility and more financing options being made available in the used car market.

In the OLX platform, the Classified Product AD page is the primary means of communication between buyers and sellers, the authenticity and clarity of the information presented in the AD Page are crucial in building trust and interaction with potential buyers, ultimately leading to successful deals. The success of online classifieds hinges on the interpretation and interaction of data between buyers and sellers.

Initially commanding a 90% market share in India's diverse used goods market, OLX's strategy was not focused on the used car segment even though this category's popularity surged. Rising new car costs drove demand for pre-owned vehicles, competitors like Cars24 and Spinny emerged, exclusively targeting the used car market, and dominated the market with end-to-end car-buying services, subsequently diverting traffic away from OLX.

Initially commanding a 90% market share in India's diverse used goods market, OLX's strategy was not focused on the used car segment even though this category's popularity surged. Rising new car costs drove demand for pre-owned vehicles, competitors like Cars24 and Spinny emerged, exclusively targeting the used car market, and dominated the market with end-to-end car-buying services, subsequently diverting traffic away from OLX.

This shift eroded OLX's marketplace position as users sought more streamlined and comprehensive solutions beyond OLX's generalized platform approach. OLX responded with OLX Autos but struggled to match competitors' comprehensive service offerings, resulting in declining user engagement and conversion rates.

OLX's marketplace, while widely used, is not designed as an end-to-end service solution. The platform offers a fragmented user experience, lacking essential features such as transaction moderation, secure communication channels, and assistance in finalizing deals. This gap becomes particularly evident in the high-value used car segment, where competitors like Cars24 and Spinny offer seamless, integrated services that simplify the buying and selling process.

Additionally, OLX faces challenges with platform navigation and user trust, as many users are deterred by the risk of fraudulent activity. These shortcomings have driven users toward competitors that prioritize convenience, safety, and a more comprehensive customer journey, further impacting OLX’s market share and user retention.

This design research seeks to enhance the user experience for both buyers and sellers on OLX's used car marketplace by identifying challenges and opportunities in user interactions. The goal is to uncover insights that will inform the development of a user-centric solution, enhance communication, boost conversion rates, and support the transition to OLX Autos.

“We see our customers as invited guests to a party, and we are the hosts. It’s our job every day to make every important aspect of the customer experience a little bit better.”

– Jeff Bezos, CEO of Amazon

This research project is divided in to two major phases,

Phase 1

Exploratory Research

-

To understand the current product information communication and perception experience from the perspective of sellers and buyers respectively in online and offline settings.

-

How do sellers want to convey the product information and how do they do it?

-

How do buyers perceive the information and what do they look for?

-

What is the narrative followed by the users?

-

How the meaning is co-constructed?

-

-

To derive key insights from the overall product information exchange experience

-

Touchpoints / User Journey

-

Shared patterns of behaviours/interactions

-

Pain points

-

Opportunities

-

Phase 2

Solution Directions

-

To validate the research

-

Design concept representations for the proposed solutions

-

Conduct user testing to bring more clarity and understand consequences

-

Methodology

Qualitative Primary Research - 1:1 Remote In-depth Interviews based on a discussion guide & use sacrificial test concepts as a stimulus for more open discussion > Collect data for analysis & synthesis of observed behaviours, pain points, and insights

Mode : Google Meet Video Call

Duration : 60 Minutes

Requirements : Mobile & Internet Connection

(Due to covid 19 restrictions, this research has to be carried out completely by online mediums)

Research Sample

Criteria : Users who are active members of the OLX platform & completed multiple purchases & sales

Buyers : Actively looking to buy a car or bought a car

Sellers : Actively looking to sell a car or sold a car

Cities : Chennai, Delhi, Lucknow, Bangalore

(Random sampling organised by a third-party research agency)

Sample Size

Research Timeline

Qualitative Data Analysis Process

Structuring Data : Transcribing Interviews > Coding The Data > Identify Key Words & Categories

Interpreting Data : Identifying Recurring Themes And Patterns > Insights Into User Needs & Pain Points

User Journey Map : Narrative Analysis (Interpret Events) > Mapping Observed User Behaviours with Events And Experiences

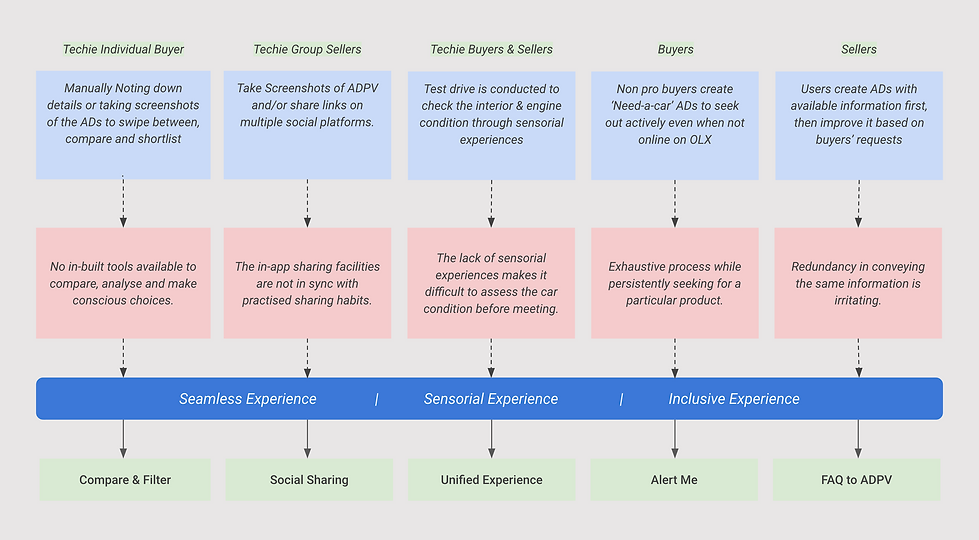

Sellers

-

Sellers are not aware of providing complete clarity of product to buyers in ADPV

-

Redundancy in conveying information is irritating for sellers

Buyers

-

Consuming information in parts costs time and cognitive load in deriving meaning

-

Exhaustive and tiring while persistently seeking out a particular product

-

No Built-in tools are available to compare, analyse, and make conscious choices.

-

AD page view fails to provide in-depth clarity which buyers gain only after conversations, inspections, test drives etc.

Generic

-

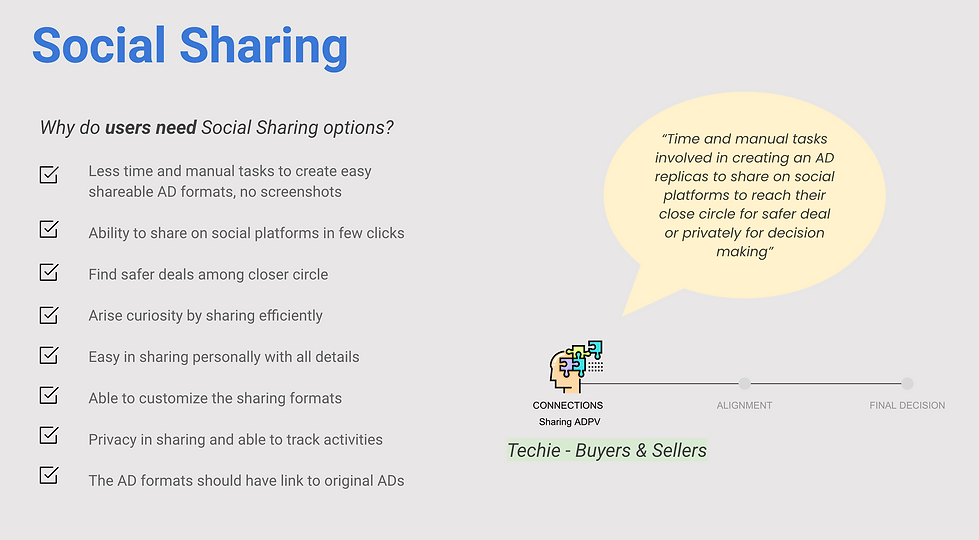

The In-app sharing facilities are not in sync with practised sharing habits

-

Chat is preferred less for its non-spontaneous nature of communication

-

Keeping track of and deciding between shortlisted users' deals is difficult

-

No nudges, notifications, reminders, etc. that support decision-making

-

Non-pro users feel the platform is less inclusive, as they rely on visual thinking and colloquial communication

Solution Directions · Phase 2

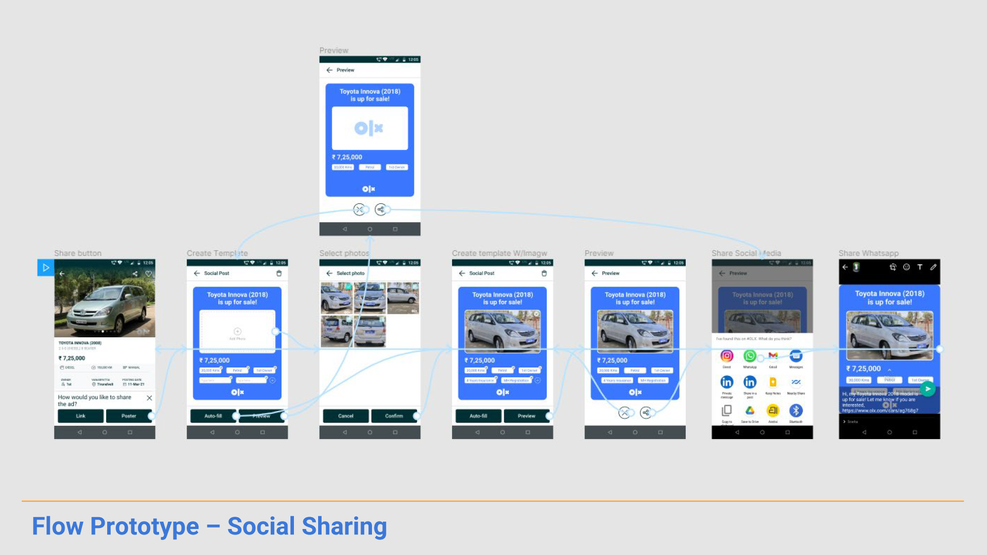

The Insights and Pain-points are validated further by developing design briefs and concepts based on the findings and taken to users for testing and feedback sessions.

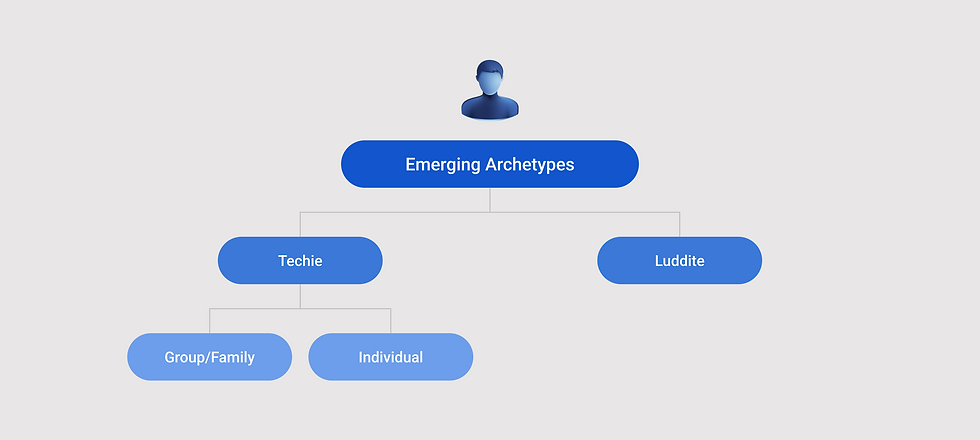

User Needs

As a first step, user needs were identified by analysis of the emerging trends. Users were primarily looking for a better experience from three different perspectives as mentioned below

Conceptualization

Concepts & Feedback

The proposed concepts were prototyped as design concepts for testing their efficiency, use cases, positives & negatives with users to collect feedback for validating the findings.

A sample of six users was involved in this study and given the prototypes to test themselves and feedback was collected under a moderated session

Given the time for explorative research and the resources available, we have identified key pain points, insights, and conceptual directions to enhance the product information exchange experience for OLX Autos

For future implementation, OLX Autos can focus on the following designer-led initiatives:

-

Addressing Pain Points: Leverage the identified pain points and insights to design innovative solutions that address user challenges effectively.

-

Validating Research Findings: Support the qualitative findings with quantitative data to ensure a robust foundation for design decisions.

-

In-depth Research: Dive deeper into the proposed directions to uncover additional opportunities and refine the approach.

-

Prototyping and Testing: Develop working prototypes or conduct experiments like fake door tests to validate the concepts and gather actionable user feedback.

Co-Researcher

Induja Menon

UX Researcher - Emerging Markets, OLX Autos

Mentor

Prachi Shrivastava

UX Researcher III - Emerging Markets, OLX Autos

Mentor

Ruma Dhingra

UX Research Team Manager - Emerging Markets, OLX Autos